Published: 10/09/18, Last updated: 6/06/23

Introduction

(last updated 9/9/20).

Despite slightly declining beef consumption rates in this country, beef is still what’s for dinner in many American households. Most consumers think of it merely as a delicious meal, turning a blind eye to the process that makes those burgers ubiquitous on restaurant menus, backyard grills and dinner tables.

But, overall, global beef production has a dangerously large foodprint: most beef production is resource-intensive and extracts a huge toll on the environment. These intensively raised cattle are kept in crowded, unhygienic feedlots and fed an unnatural diet. They produce toxic amounts of methane gas, making them a prime contributor to global warming. They’re slaughtered at speeds that are too fast to ensure safety for workers or to prevent feces from contaminating their meat. This system is bad for cattle, devastating for our environment, dangerous for the workers who process them and unhealthy for the humans who eat the meat.

There is an alternative. There are models in this country for what sustainable beef production can look like: ones that are better for the animals, for workers, for local communities and for the environment.

What Beef Should Be

- From cattle raised in clean and healthy conditions, primarily grazing on pasture.

- From cattle raised without hormones or other drugs (using antibiotics only to treat sick animals).

- From cattle allowed to display natural behaviors.

- From cattle raised by independent farmers who have fair access to processing, distribution and retail markets.

- Produced with the least possible negative impact on the environment.

- From animals on well-managed, biodiverse, pasture-based systems and fed a forage-based diet.

- From animals transported and slaughtered humanely, including pre-slaughter stunning.

- Transported and slaughtered humanely with minimal stress and suffering, and in facilities that pay the utmost attention to animal health and welfare.

- Butchered and handled carefully and safely.

- Processed by well-trained workers making a livable wage, working at safe speeds and without injury.

- Tasty and nutritious.

Unfortunately, most of the beef on the US market meets none of these criteria. This is bad for people, the animals, local communities and the planet.

The Beef Industry is Powerful

At 80 billion dollars annually, the US beef industry is the largest in the world. Four companies in the US control 80 percent of the beef market. 1 This consolidation of power in the hands of a few corporations has implications for the entire production system. These large companies limit access to processing and markets for small- to mid-size independent producers – making it hard for such farmers to compete economically.

The corporations’ large size has also made them powerful lobbyists, which has led to looser safety regulations and less oversight. 2 Beef trade groups and their largest corporate members are often the drivers and beneficiaries of global negotiations on beef. 3

Note that beef is now a global commodity, too, and that the US also imports beef from Australia, Canada, New Zealand and other countries. 4

How Beef Cattle are Raised

Beef from well raised, pastured, unconfined, 100 percent grassfed cattle is the best choice for animal welfare, the environment and your health. This system requires a high degree of farming skills for both livestock and pasture management.

Pasture Management

Most of the millions of beef cattle that end up in feedlots start out life on pasture, on one of the thousands of farms around the country that manage small herds. Many of these farmers use herbicides and fertilizers to varying degrees to maximize the growth of the kinds of plants cattle prefer. These intensive chemical-based systems are not as healthy for animals and not as environmentally resilient as well managed, diverse pasture systems.

- Feedlot

- An area or building where cows are kept for fattening up — on grain — just before slaughter.

Finishing Beef Cattle

During what is called the “finishing” period in their last four to six months, most beef cattle in the US are moved to a feedlot to quickly reach their “finishing weight.” In the feedlot, the animals expend less energy and are fed a high-calorie, grain-based diet, supplemented by food system byproducts and hormones to make them gain weight more quickly. A grain diet increases levels of E. coli in the animals and their waste, and standing in mud and manure with thousands of others increases their risk of disease. This is in stark contrast to systems that either finish animals on a more sustainably-produced grain-based diet (e.g., organic — but note that these animals may still be finished in feedlots); or — the gold standard — on a pasture-based diet with little supplementation.

The Problems with Conventional Beef

The differences between raising cattle in an industrial feedlot versus a pasture-based system are stark, and they impact animal welfare, environment, public health, workers, local economies and more.

Poor Animal Welfare

Cattle finished in feedlots experience intense stress and unhealthy environments, are given feed that is inappropriate for a ruminant’s diet and are subjected to inhumane treatment.

Here are ways that this stress affect cattle:

Inability to Display Natural Behaviors

Standing in crowded feedlots, not enough space is allotted for animals to engage in natural behaviors. If the animals have horns, these are usually removed to prevent them from injuring each other. In feedlots with slatted floors, animals’ tails may also be “docked,” or cut, to prevent infection that may arise when the tail is damaged from being caught in slats or stood on by other animals; both procedures are generally performed without anesthesia or analgesia. (Without the full length of their tail, animals cannot keep flies away, which may lead to increased skin irritation from insect bites.)

Stress

The stressfulness of the animals’ conditions can elevate their stress hormone levels. That’s not only bad for the animals but can also adversely impact meat quality. 5

Health Problems

Feedlots may not have adequate protection from extreme weather. Animals can develop skin infections from spending months standing in their own waste, and respiratory infections from dust generated in grassless feedlots. 6

Inhumane Practices

Hot prods or electric shocks are commonly used to move cattle, and while more humane methods of transport have been developed, the crowding, noise and sudden movements can still cause stress for the animals. 7 Transport vehicles are crowded, hot and often lack proper ventilation and adequate water. 8

Lines Too Fast

Problems like incomplete stunning or killing can occur, especially with fast line speeds at processing plants. 9 (See Worker Health and Safety for more on line speeds.)

Cattle Feed

Cattle are ruminants and graze on grass and other forages (plants that grow alongside grasses). However, no grass grows in feedlots — in fact, part of the definition of a concentrated animal feeding operation (CAFO) is that animal traffic is so intense that grass does not grow.

The diet of feedlot cattle primarily consists of grains; generally, a mix of corn with soybeans for protein. Their diets can also include:

- Byproducts or excesses from other parts of the food system, such as candy, orange pulp from juice factories, cookie crumbs and other bakery waste, beet tops from sugar production or spent distillers’ grain.

- Animal byproducts, including poultry litter and animal waste. 10

Cattle’s four stomachs are designed to digest grass, not grain. Grain increases the acidity of the digestive tract, a condition called acidosis, which causes physical discomfort, intestinal damage, dehydration, liver abscesses and even death. 11 E.coli thrive in this acidic environment, and can contaminate the meat if it is not processed carefully. 12

Additionally, the market price of feed made mostly of corn and soybeans is about 25 percent below the cost of production of these grains mainly due to various state and federal policies, which essentially “subsidizes” large scale industrial animal agriculture by keeping feed prices artificially low. 13 If industrial producers had to pay full costs for their feed, the cost advantages they enjoy would be significantly or entirely eliminated. 14

Animal Health Equals Human Health

Americans consume about one pound of beef per week – three times more than the recommended portion (of two to three ounces of red meat served once or twice a week). When it comes to what animals eat: what’s good for animals is good for people. Grain feeding limits animals’ ability to create certain kinds of conjugated linoleic acids (CLAs), considered “good” fatty acids, specifically omega-3 fatty acids, which have many human health benefits, including reduced cancer and cardiovascular disease risks. (A CLA ratio of omega-6 to omega-3 fatty acids between 1:1 and 4:1 is considered ideal.)

Grassfed beef typically is high in omega-3 fatty acids, while grain-fed beef has almost none (both have similar omega-6 profiles). 15 Grassfed beef also has higher levels of antioxidants such as Vitamins A and E, along with enzymes superoxide dismutase and catalase, which fight free radicals.

Better Animal Welfare Options

There are options for eating better beef. Farms that use humane animal welfare practices follow standards for animal living conditions. These include:

- Providing adequate space for animals to graze and engage in natural behaviors.

- Providing adequate animal waste management; on pasture, manure is naturally composted into the soil, improving soil quality.

- Castrating male animals by two months of age to minimize pain and discomfort.

- Avoiding other physical alterations, like tail docking and horn removal.

- Using drugs (including antibiotics) only to treat illness.

There is only one animal welfare certification that positively exceeds these baseline practices, prohibiting confinement and requiring high standards for slaughter and transport: Certified Animal Welfare Approved by A Greener World (AWA). 16

Environmental and Community Impacts of Beef Production

Industrial beef production is highly resource-intensive. Inputs into the system are excessive and highly concentrated — and so is what results.

Too Much Manure

One of the most negative aspects of industrial beef and other animal production is excessive amounts of manure.

Manure can be a rich source of soil nutrients. When applied in appropriate amounts, manure returns nitrogen and phosphorous to the soil, enriching farmland, pastures and grassland. Industrial animal farms can produce between 2,800 tons and 1.6 million tons of animal waste a year. 17 It is estimated that 500 million tons of animal waste is produced each year from all industrial livestock operations, three times more than the sewage produced by the US population. 18 And depending on the climate, feedlot animal waste is either collected in large holes in the ground (called lagoons) and sprayed untreated on farm fields, or it simply dries out on the feedlot and turns to dust. Lagoons can leak; animal waste sprayed on fields can run off the soil; dust blows away.

There are many environmental and community impacts from such vast quantities of animal waste:

- Animal waste that seeps into groundwater or runs off into surface water carries excess nitrogen and phosphorous, which can cause algal blooms and die-offs of aquatic species. 19

- Bacteria and other pathogens in manure dust can cause health problems.

- Residues of growth-promoting hormones, antibiotics and antibiotic-resistant bacteria are all found in feedlot animal waste. These contaminants seep into soil and water and disperse into the air along with the animal waste, where they become health hazards for workers and for the public.

- Overwhelming odors from large quantities of animal waste — combined with attending health risks — result in lower property values in surrounding communities.

The Water Footprint of Beef

Not only does feedlot animal waste pollute water, but intensive beef production also uses an extraordinary amount of fresh water. Cattle are relatively inefficient at converting feed to meat. 20 In an intensive (grain) feeding system, one percent of gross cattle feed calories are converted into calories that humans can eat; and only four percent of the protein that cattle eat becomes protein that humans can eat. More feed equals more water. Calorie for calorie, beef cattle raised intensively consume more than double the amount of water used by lamb, and more than three times the amount used by chicken. 21

The water footprint of beef is primarily determined by the volume and quality of the cattle’s diet and how the feed was grown. Depending on the region, feed grain and pasture can be grown primarily or exclusively with rainfall, but the corn and soybeans grown for conventional feedlot feed are more likely to depend on irrigation. 2223

Irrigation is rare on pasture, though in dry years farmers supplement their own grass with hay, which increases the water footprint.

Climate Impacts and Greenhouse Gases

There is a debate at the heart of beef production methods and climate effects. Beef production requires a lot of energy and is one of the biggest generators of greenhouse gases. Cattle, like all mammals, burp and fart. Their emissions contain significant quantities of methane, a greenhouse gas 25 times more potent than carbon dioxide. 24

The science is still evolving, but we know:

- That pasture health is correlated to the soil’s capacity to trap, or sequester, carbon, which is a good thing. 25

- That large scale cattle operations require animal waste pits, piles and lagoons, which can concentrate and amplify nitrous oxide production.

- The pesticides and fertilizers used in conventional corn and soy production are made from fossil fuels, further entrenching the oil and gas industries in this industrialized system. 26

- That sustainably managed, pasture-based systems compost waste directly into the soil and that overall, there is a “carbon negative” or climate benefit opportunity from pasture-based systems that are managed properly.

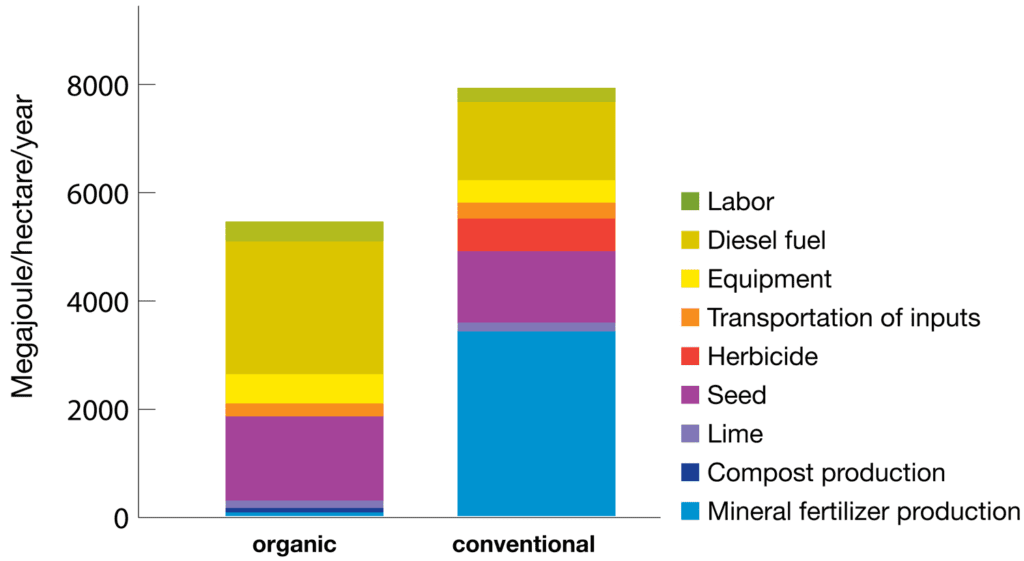

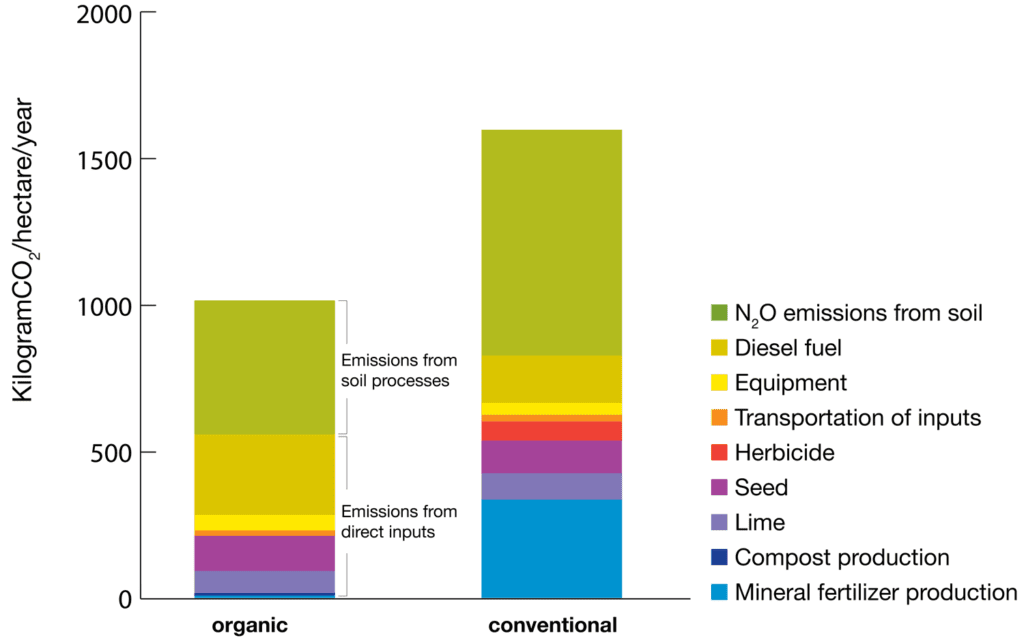

Reproduced with permission from the Rodale Institute.

Reproduced with permission from the Rodale Institute.

However, there is still considerable debate around the climate impacts and benefits of both industrial and pasture-raised beef. On the one hand, current studies do not account for the ability of soils/pasture to hold (sequester) carbon from the atmosphere. On the other hand, grain-finished, confinement operation proponents argue that overall, they can finish animals in a shorter time (with fertilizers, drugs and pesticide-intensive grains, however) and therefore can offset the climate benefits of pasture. But, of course, this industrial model of raising cattle comes with compromises to animal heath, soil health, environmental health and public health. 27

A carefully controlled study by the Rodale Institute, conducted in comparison fields, illustrates the potential and promise of pasture-based systems overall — and in climate impacts specifically. 28

Progressive farmers around the world are studying pasture-based systems closely as an opportunity to reduce the climate impact of beef production. Soil is alive. When nurtured in a pasture-based system (without chemicals or drugs), healthy soil can absorb a great deal of carbon dioxide from the atmosphere and be an extremely efficient “carbon sink” that can also process manure directly on site and into the soil. The better and more diverse the pasture and the deeper the root structure, the more carbon it can sequester. Alternative cattle breeds are also an important element of the system. Animals bred for feedlot production are not necessarily the best at optimizing energy conversion from grass in a pasture-based system.

These types of regenerative practices explore new frontiers, beginning with improving soil health (not just maintaining it), which helps the environment all the way up the food production chain. Some of the methods currently being implemented will define the best beef farming practices of the future — not only for reducing and capturing greenhouse gas emissions, but to get animals to their finishing weight quickly without compromising the health of the entire system.

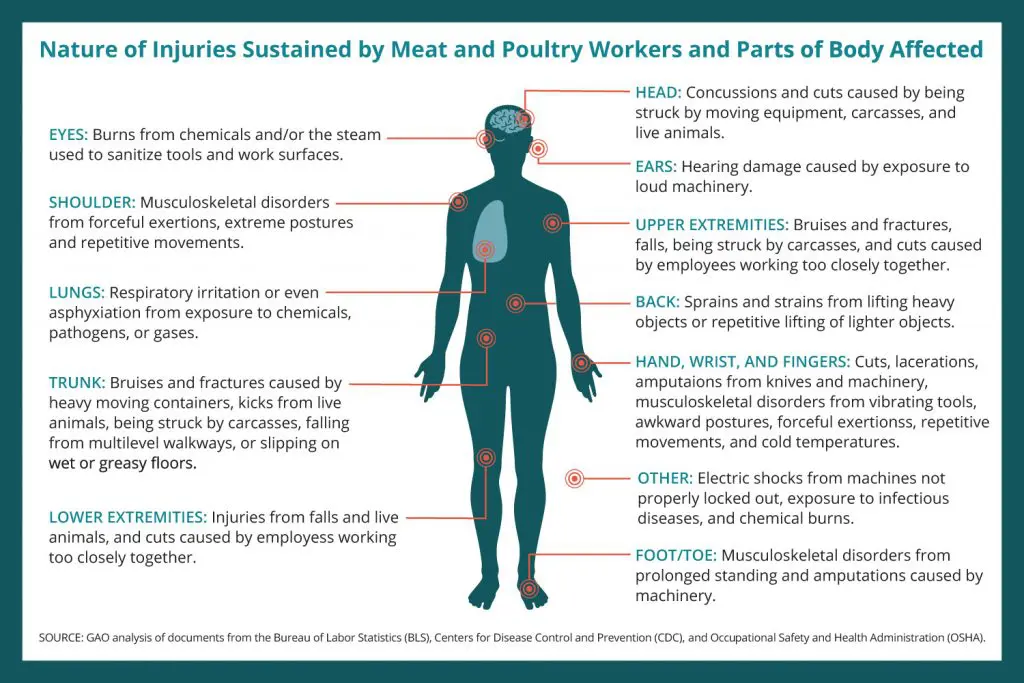

Worker Health and Safety

It is not only the animals who suffer in the industrial feedlot system — workers on farms/feedlots and in processing plants do, too. But what happens when workers try to change that system? Whistleblowers are often harassed into stopping their complaints, or are outright fired, with little legal recourse.

Here are some of the ways that worker health and safety are compromised in industrial beef production:

On the Farm

Working with cattle is physically demanding and can be dangerous. According to the Occupational Health and Safety Administration, in 2011, injury rates for workers in animal agriculture were 6.7 per 100 workers, compared to an average rate of 3.8 injuries per 100 for all workers. 29 Workers are also exposed to toxins and pathogens in the animal waste, and where antibiotics are used daily, studies show farm workers are at higher risk for exposure to antibiotic-resistant bacteria. 3031

In Processing Plants

Animal slaughter and meat processing are also extremely dangerous jobs. While injury rates in processing plants have declined over the last decade, they are still among the highest in the manufacturing professions. According to the US Government Accountability Office (GAO), more can and should be done to track and protect workers from injury and illness.32

Despite the dangers, meat-processing workers are poorly paid and often exploited. For example, until a 2016 Supreme Court ruling, workers were not paid for the time they spent putting on and taking off protective gear at the beginning and end of their shifts. 33

Increasing Line Speeds Increases Danger

To maximize profits, processors regularly increase the speed at which animals are processed. Today, plants slaughter as many as 400 animals an hour. 34

The speed at which meat-processing workers are expected to work, along with sharp tools, strong chemicals and hot pressurized water, contribute to a high injury rate. And the injuries are serious: torn muscles, pinched nerves, broken bones, deep cuts and crippling repetitive stress injuries. Even amputated fingers or limbs are common. 35

What Better Worker Welfare Means

Better worker welfare includes many elements:

- A livable wage.

- Safe conditions with fewer (and well-managed) physical, chemical and biological hazards.

- Slower line speeds. This allows for more careful cutting and processing and can dramatically improve worker and food safety.

Food worker safety has been slow to be addressed in the US, both at the governmental level, where regulations are inadequate, and by the good food movement, which has focused more on environmental and health concerns.

99,000

illnesses were recorded from contaminated beef between 1998 and 2008

Food Safety and Public Health

The Centers for Disease Control (CDC) estimate that each year at least 48 million people will be sickened, 128,000 people will be hospitalized and 3,000 people will die from foodborne illness. 36 CDC estimates suggest that 22 percent of these illnesses and 29 percent of foodborne illness deaths are attributable to beef. 37

Between 1998 and 2008, beef accounted for:

- 99,000 illnesses from Salmonella and coli.

- Nearly 2,400 hospitalizations.

- Thirty-five deaths.

- $356 million estimated health care costs. 38

The scale on which industrialized meat is produced makes it difficult to address foodborne illness outbreaks. One meatpacking plant processes thousands of animals per day and the meat is shipped around the country. One hamburger might contain beef from 100 cows. 39 Tracing a contaminated product back to its source is therefore a challenge – it is also a race against time, as other consumers may be eating the same tainted meat. Even once the source is found, the government does not have authority to issue a meat recall, only to make a causal assessment. A recall must be voluntarily issued by the violating company. 40

Bacterial contamination happens when intestinal contents or fecal matter come in contact with the meat during slaughter and processing. Processing at high speeds, as is now common with industrially produced and processed meat, requires workers to work more quickly and be less careful, increasing the risk of contamination.

While illness outbreaks caused by E. coli bacteria may get much of the media attention – and in fact, beef is the most common food cause of E.coli infection – it is far from the only bacterium or toxin found in beef. 41

Salmonella bacteria are the most common cause of foodborne illness across all foods; Staphylococcus aureus, Listeria monocytogenes, Clostridium perfringens and Enterococci are some of the other illness-causing pathogens found in beef. The US Department of Agriculture requires testing only for Salmonella and a specific strain of especially dangerous E.coli. 42 While any beef that tests positive for the E.coli strain is prohibited from being sold raw, 7.5 percent of ground beef is legally allowed to contain Salmonella and be sold. 43

In 2015, Consumer Reports tested various kinds of raw ground beef for bacteria. They found that beef produced without antibiotics, with organic and/or grassfed practices, was significantly less likely to test positive for E.coli than the samples of industrially-produced beef. The industrially-raised beef also had higher levels of Staphylococcus aureus, suggesting contamination from handling and processing. 44

Meat from pastured animals has less risk, discussed in detail below.

"...we do mix beef from different delivery batches and the resulting batches [of burgers] can be made up of the meat from more than 100 cattle."

Antibiotic Overuse and Antibiotic Resistance: A Public Health Crisis

An even more alarming danger being bred in feedlot beef cattle is antibiotic-resistant bacteria. Antibiotics have been used in livestock feed since the 1940s, when studies showed that the drugs caused animals to grow more quickly. 45 While the FDA banned the use of antibiotics for growth purposes starting in 2017, there is likely little ability to enforce these rules. 46 Today, non-therapeutic antibiotics are routinely given to livestock on industrial farms to prevent disease that may otherwise be caused by crowded and unsanitary conditions.

The problem is that misuse or overuse of antibiotics leads to evolution of antibiotic-resistant bacteria rendering these powerful and life-saving drugs obsolete. When bacteria are continually exposed to small doses of an antibiotic, those resistant to the drug survive and reproduce while the rest die off, resulting in a new bacteria population that is resistant to the antibiotic. 47

The World Health Organization and many other public health bodies consider antibiotic resistance a global public health crisis, with more than half of some bacteria groups in some countries already resistant to antibiotics. 48 In the US, at least two million people are infected annually with antibiotic-resistant bacteria, and 23,000 die. 49 And yet, there is not enough movement to curb the biggest contributor to this looming threat: 80 percent of all antibiotics sold in 2014 were for use in farm animals. 50

Antibiotic-resistant bacteria bred in feedlots do not stay there. Both antibiotics and resistant bacteria can leech into surface and ground water from animal waste sprayed on fields. 51 Bacteria also travel on workers, on flies and in the air – as well as contaminating improperly-handled meat. 525354

Of additional concern, in Consumer Reports’ 2015 findings, methicillin-resistant Staphylococcus aureus (MRSA), an increasingly common strain of bacteria resistant to many antibiotics, was found in three samples of conventional beef. MRSA was not found in the more sustainably-raised beef Consumer Reports tested. 55 Organic and/or grassfed beef was half as likely to contain multi-antibiotic-resistant bacteria as feedlot-finished beef, and 100 percent grassfed meat was three times less likely to carry these strains. 56

Other Drugs and Additives in Meat

Drugs, including growth hormones, are regularly given to cattle in feedlots to make them gain weight more quickly on less feed. Some of these drugs, like the growth-promoter ractopamine, have been banned in many other countries. 57

Approximately 450 drugs are approved for use in US animal production, many of which can be used for non-therapeutic purposes — that is, for purposes other than treating disease.

Unfortunately, today’s food safety measures focus on specifics of meat processing rather than taking a holistic view of the ways in which the whole system is at risk for contamination. Measures such as visual inspection, occasional testing and end-of-the-line solutions (like antiseptic washes) or packaging gases (like carbon monoxide, which keeps meat looking red for longer) are the primary lines of defense against bacterial contamination. Additionally, additives like these are considered “processing aids,” and, like drugs fed to the animals, are not required to be disclosed on the final product.

The Power of the Beef Industry: An Uneven Playing Field

Demand for beef is high, and by creating vast economies of scale in its feedlot production systems, the beef industry has not only met that demand but done it cheaply. Proponents of industrial agriculture point to the high volume of low-cost food that it produces.

However, the drop in the cost of meat over the last few decades is due, in part, to how confinement production leverages economies of scale; but it is also due to externalization of costs and to the political power of the meat industry.

Externalization of Costs

While the companies reap all the profit from livestock production, there are many costs intrinsic to the process that they literally do not pay for and which are instead often borne by taxpayers. These include (but aren’t limited to):

- The costs of cleaning up polluted water, air and soil.

- Health care costs for asthma or other illnesses associated with concentrated animal feeding operations (CAFOs).

- Property values lost when a CAFO moves into a community.

- Lost jobs and tax revenue as small businesses close due to corporate consolidation.

- Externalization

- How a business maximizes its profits by off-loading indirect costs and forcing negative effects to a third party — in the case of the beef industry, the taxpayer.

Political Power in the Meat Industry

These cost externalizations have been allowed to develop because the meat industry has become politically powerful. Just four companies (Cargill, JBS, National and Tyson) own and operate 80 percent of beef processing. 58 As these meatpacking companies have grown, they have bought up more parts of the supply chain in a process called vertical integration: rather than several different companies owning the feedlot, the slaughterhouse and the processing plant, one company owns all those pieces. 59 Other livestock industries are even more vertically integrated than beef; the big poultry companies, for example, own the entire supply chain (with the sole exception of the facilities where chicks grow to full size – to the extreme detriment of the growers, or owners, of those farms) from egg genetics through chicken cutlet.

The beef industry, by contrast, still has cow-calf farmers raising calves on pasture and grazing cattle on ranchland. The problem is that the big meatpackers control the market for cattle to become beef. Independent farmers and ranchers can sell their cattle to a feedlot for finishing, but if they instead want to raise their animals on grass until they are ready to be turned into beef, they have few options.

In comparison to past decades, there are fewer processors and distributors who will purchase cattle from a farmer, slaughter and process them, and also have market access for the beef. This means farmers sometimes have to transport their animals long distances to slaughter, further driving up the costs of grassfed beef. 60

Beef Industry Marketing and Lobbying Practices

In part, the industry has been able to do all of the aforementioned, because of a federal program called Checkoff, which requires livestock farmers to pay a tax on every animal sold which is allocated to private trade groups like the National Cattlemen’s Beef Association. These groups, which primarily now represent large meatpackers rather than family famers, use the revenue to support advertising (including campaigns like, “Beef. It’s What’s for Dinner.”) and research, while also lobbying for policies that are beneficial to large-scale industrial agriculture and detrimental to independent family farms. Checkoff is now essentially a tax that works against the interests of most of the people who pay it. 61

In another example, consumers and progressive ranchers have long supported Country of Origin Labeling (COOL) laws for meat, which were passed in the 2002 Farm Bill. For farmers, COOL was a way to distinguish their US-raised beef from imports, which was a helpful marketing tool; consumers liked having the option to purchase meat from cattle grown in the US specifically. The meat trade associations, however, lobbied hard against COOL because the big meatpackers are multinational and the ability to sell unlabeled meat across borders is better for their bottom line. The USDA eventually repealed COOL, following a suit by Canada and Mexico over the rules at the World Trade Organization. 62 There are currently no laws requiring country of origin labeling on meat, despite wide consumer support.

The Promise of Sustainable and Regenerative Beef

What animals eat, how they are raised, whether they were given drugs regularly for non-therapeutic purposes, how they were treated, how they are processed: these factors all have big impacts on the environment, animals, workers, public health and the meat itself.

One-off stopgap “solutions” to the problems of industrial beef production do not take the entire system into account. Though they may produce short-term changes, they do not make the necessary long-term impact. Until we address the whole system, including animal welfare, non-therapeutic drugs, animal waste, worker safety, farmer livelihood and more, we will continue to fall short in having the healthiest food production system for animals, the environment, for our communities and for our families.

Organic-Based Agriculture

Organic and biodynamic production systems have been around since the 1970s and 80s, laying out not just a philosophy, but a set of production practices that are fundamental to current sustainable agriculture systems. In 2002, the USDA started the National Organic Program, which include the standards that strongly underlie environmentally sustainable practices addressing chemical, pesticide, fertilizer and drug use. These practices include:

- Farms must have plans including tracking inputs and outputs.

- All feed for animals must be 100 percent organic.

- Livestock are required to have continuous access to pasture during the grazing season.

- Livestock must be allowed 120 days on pasture annually.

- Pasture must be organic, which means that it cannot be treated with synthetic or sewage sludge-based fertilizers or synthetic pesticides. 63

Today, “organic” is a label that needs to be further strengthened with additional certifications for worker and animal welfare, too.

Regenerative Animal Agriculture

The concept of sustainability is evolving into a broader concept of regenerative: production that not only minimizes harm to animals, the environment, workers and public health, but optimizes benefits in each of those areas by replenishing the land to complete the circuit.

Through the lens of regeneration, a region’s ecology, biome, physical and chemical properties all play a role in building healthy soil, including pastures for beef cattle. The better the soil, the better the root structures; the better the pasture, the more nutritious for animals and the less need for pesticides, fertilizers and other inputs. But regenerative systems go beyond soil to include other environmental, animal and worker health and welfare practices. 64 Building regenerative practices on an organic foundation has a lot of advantages, including market clarity.

Raising truly sustainable beef means that animals graze on pasture and are not confined. Regenerative practices maximize the beneficial relationship between herds and grassland and can improve soil health and the quality of the pasture – reducing the need for supplemental feedstocks. 65

Regenerative pasturing principles call for animals to be concentrated in one area until they have eaten the grasses down, as well as turned up the soil with their hooves and left their manure to compost. They are rotated to another pasture while the spent pasture absorbs the nutrients left behind in the turned up soil and the grasses regrow. Practiced properly, this technique can improve and regenerate the soil and grassland.

Such healthy and nutrient-rich soil has many benefits, including:

- Grows stronger and more nutrient-rich grass.

- Is able to hold more water, reducing runoff and erosion.

- Evidence suggests that such soil can sequester carbon, offsetting some of the methane production intrinsic to raising cattle. 66

- Support greater biodiversity — including earthworms and insects that further work the soil, beneficial insects and pest predators.

Along with improved grassland and healthier meat, raising ruminant animals this way allows them to eat what they naturally eat, reduces the need for medical care, decreases the stress and discomfort experienced during transport and crowding and allows animals to exhibit their natural behaviors — including that most essential behavior of eating grass. In short, raising cattle on pasture measures up to the highest levels of animal welfare practices. 67

Let's Fix This: Creating a System That Makes Sense

Until we have better regulations that change the way most of our beef and other meat is produced, the ability to shift demand is in the hands of those who are buying: consumers, institutions, retail outlets, schools, hospitals and more.

Collectively, we can shift demand. Here’s how:

1. Reduce Consumption

There are many reasons to decrease how much beef you eat. If nothing else, beef is a resource-intensive, inefficient food: only one percent of gross cattle feed calories is converted into calories humans can eat, and only four percent of the protein cattle eat becomes protein humans can eat. Consuming less beef overall can also mean spending your beef dollars on more sustainably produced, better quality meat, instead.

To put a more positive spin on it: the less beef that needs to be raised, the better that beef can be — meaning fewer environmental impacts with healthier results for animals and people.

Sound daunting to eat less beef? Here are some ways to get started:

- Limit red meat consumption to one to two times per week or less. Meatless Monday can help.

- Re-think serving size. USDA counts just two to three ounces as a serving, but beef is often sold in large cuts and restaurants commonly offer servings of six to eight ounces.

- Move meat to the side. Serve plant-based foods at the center of the plate, and treat meat as a side or a treat.

- Use meat for flavor. Take a cue from cuisines that combine small amounts of meat with larger portions of vegetables or grains.

2. Look for Labels that Mean Something

Beef labels are complicated. There is no one label that comprehensively accounts for if the cow was raised entirely on pasture, if that pasture was sustainably maintained, if the animal was well treated and if the workers were fairly treated and compensated. As a result, consumers must decide what factors are most important to them and then seek out the appropriate label.

The most comprehensively useful labels you can find are the Certified Grassfed by a Greener World (AGW) (an optional, additional accreditation to Certified Animal Welfare Approved by AGW), the PCO Certified Organic Grassfed label and the NOFA Certified Grassfed label since they require that the animals ate a pasture-based diet of only grass, were never confined to feedlots, and had no daily diet of drugs. The certified Animal Welfare Approved by AGW label (without “Grassfed”) is also very meaningful when it comes to animal welfare standards, including comprehensive standards for raising, transport and slaughter.

The USDA Organic label has among the strongest standards for environmental sustainability, including prohibiting synthetic fertilizers and industrial pesticides, as well as stringent standards for 100 percent Organic feed. The Certified Naturally Grown label, started by farmers who did not want to go through the organic certification process, has similarly high sustainability standards, but does not include third party certification, as with USDA Organic or the Animal Welfare Approved by AGW labels. Higher than both of them is the Biodynamic label which would be our very top pick if it were more widely available. Though it is not widely available, the Food Justice certification is a comprehensive label for social justice in farming and requires farms to be certified organic as a prerequisite.

To learn more about the many labels you might find on your beef, which ones are useful and which are less so, visit our Food Label Guide guide.

3. Make the Most of What You Buy

Knowing what different cuts and grades of beef are will help you make the most of the meat you buy.

Understanding the Grading System for Beef

While the USDA has established grading (“prime,” “choice” and “select”) for grain-finished beef, it has not established grading for grassfed beef. That’s in part because grassfed beef is leaner than grain-finished, so the fat marble grading system isn’t directly applicable. The best grassfed beef will come from animals that grazed as much as possible on diverse pasture. Look for “pasture raised” along with certified grassfed claims to buy the best quality grassfed meat.

Beef Cuts

If you don’t know what the cut is, you won’t know how to cook it. Both an overcooked tenderloin and an undercooked chuck roast will be tough and less than tasty. This is especially true for leaner grassfed meat.

A general rule is that the more active the part of the cattle the cut is from, the longer and slower it needs to cook. Cuts from the core of the animal — anything with “loin” in the name, along with cuts like hanger steaks and flatirons — are muscle mass that hasn’t had to work very much and is thus more naturally tender. These cuts can be cooked quickly.

Cuts from the extremities, large joints and other load-bearing areas are tougher because they’ve worked more. Hip, shoulder, legs, neck — meat from these areas of the animal need to be slowly roasted or braised to allow the tougher connective tissue cook down and become tender.

4. Find Great Local Farmers and Ranchers

Despite the challenges, more and more farmers are raising beef using sustainable practices. Buying directly from producers — through community supported agriculture (CSAs) or at farmers’ markets — can be a good way to support those efforts and get amazing grassfed beef. Note also that many of the labels mentioned above have directories of certified farms and/or brands.

5. Work Towards Change Beyond Your Table

Ethical consumerism — individual people making better choices when they purchase beef — is a great starting point, but working towards better regulations and practices industry-wide is also important.

- Follow us on Twitter for the latest news about policy developments and what you can do to help push policy in a more sustainable direction.

- Read our blog to stay up to date on food issues.

Meet Some Farmers Who Are Getting It Right

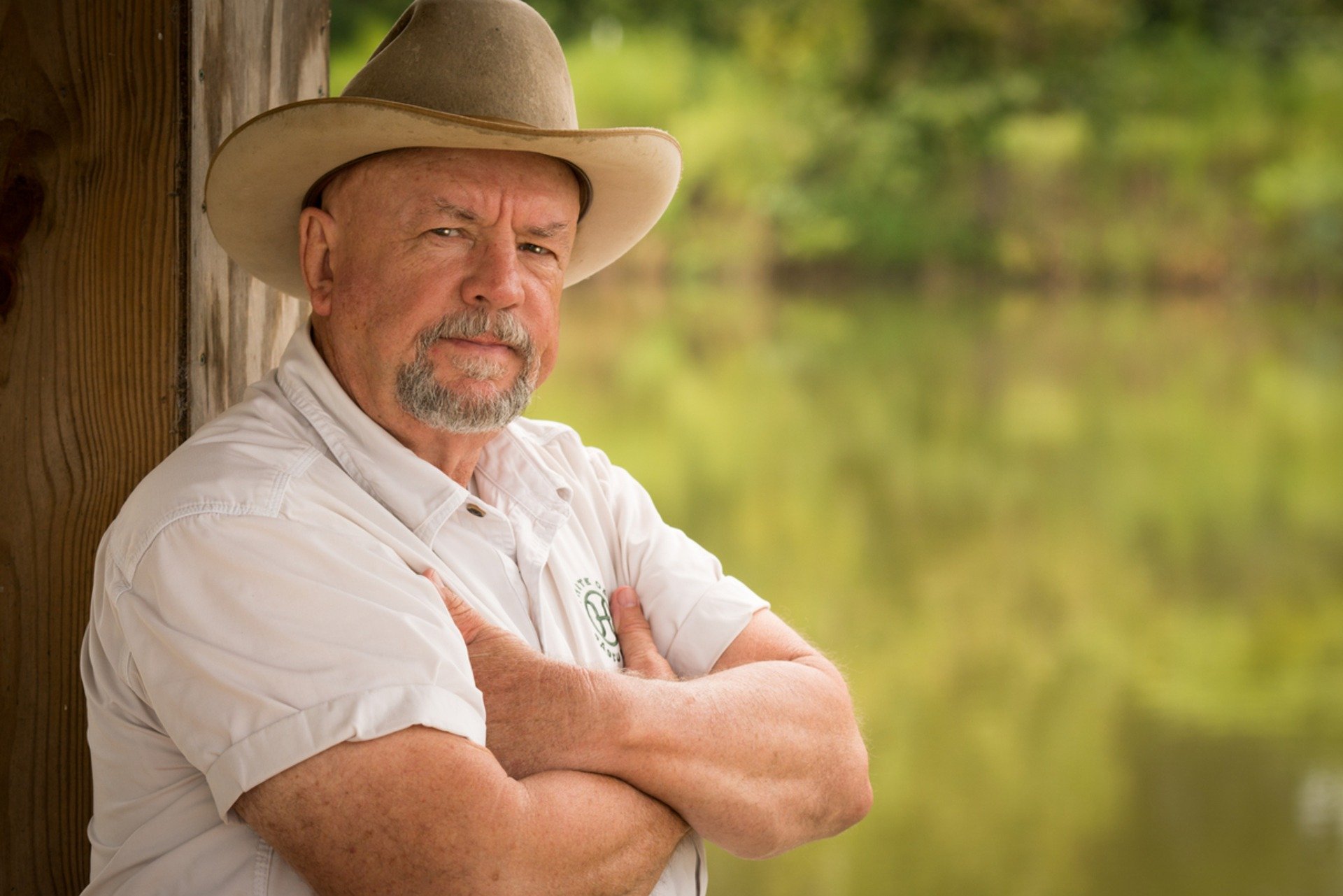

Will Harris raises cattle and other animals on land his great-grandfather started tending in 1866. After a life of raising cattle following post-World War II industry “best practices” that included pesticides, antibiotics and hormones, in the mid-1990s he started to realize that his ranch had become a monoculture. He ditched the chemicals and began working the land, much as his great-grandfather had, following sustainable practices that benefitted the soil, the animals, the people who worked the ranch and the people they fed. White Oak Pastures is now a model of sustainable farming in the US.

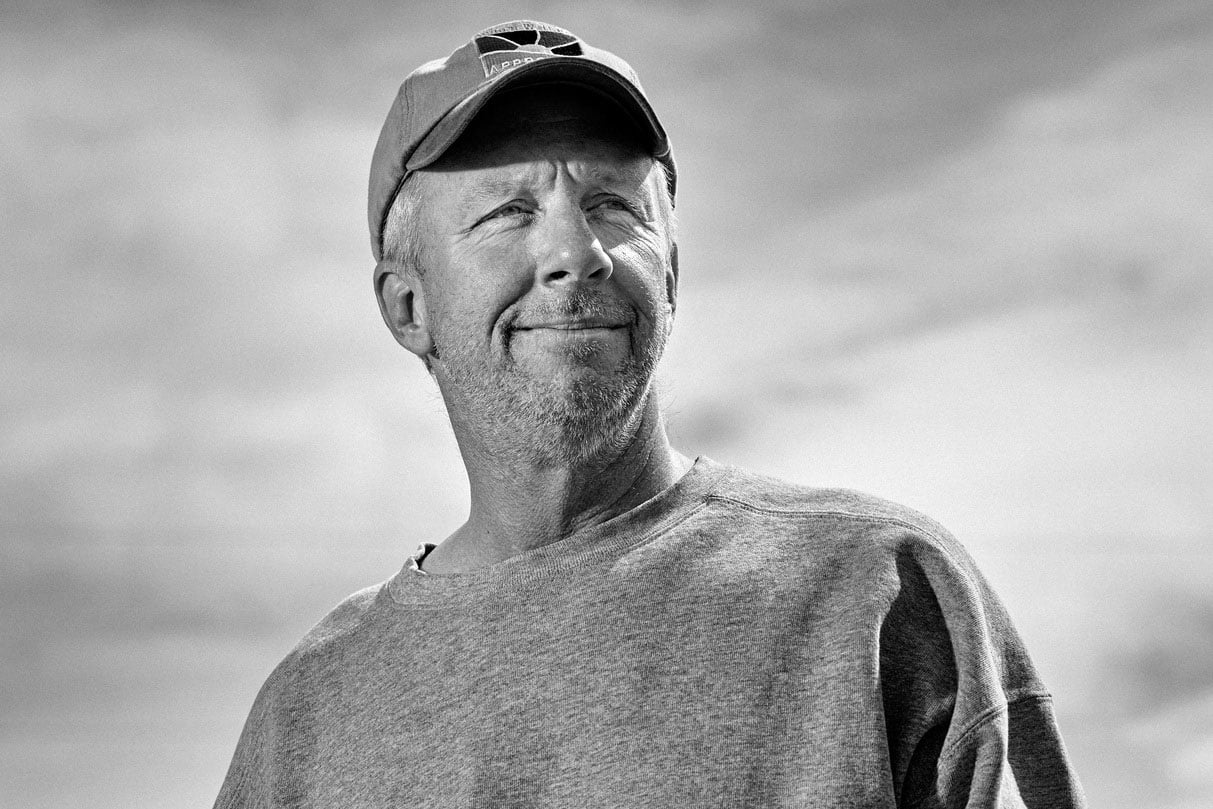

Dan Gibson of Grazin’ Angus Acres Farm takes grassfed beef seriously. He’s spent years cultivating the most nutritious grass for his herd of 300 Black Angus cattle, a feed that he says results in beef with as much omega-3s as wild salmon. And rather than slaughter at the typical 12 to 15 months, Dan allows his cattle to graze for around three years, allowing for fully marbled, highly nutritious beef. These high standards have earned Gibson the seal of approval from third-party certifier Animal Welfare Approved, based on his care and concern for his animals and quality product. And at Grazin’, his Hudson, NY diner — the first Animal Welfare Approved restaurant in the world — you can taste that grassfed beef first hand and witness the synergy between restaurant and farm.

What Needs to Change

- Meaningful animal welfare standards should be included for USDA Organic certification for meats and dairy.

- Clear antibiotic labeling and no non-therapeutic use of antibiotics. Antibiotics should only be administered to treat illness.

- Rigorous USDA standards for “grassfed” that do not allow confinement, regular drugs or feed produced with pesticides and fertilizers.

- No more “natural” on labels. A Consumer Reports survey found that consumers are under the impression that “natural” is more credible than “organic.” However, this could not be further from the truth. “Natural” has such minimal requirements as to be meaningless, whereas “USDA Organic” is a certified, verifiable label.

Conclusion

While there are huge problems with the system by which most of the beef on the US market is produced, there are clear solutions at our fingertips. Some of those solutions are in the hands of farmers — like the ones we mention here. Some of these are in the hands of consumers — such as eating less industrially-produced meat and supporting the producers who are modeling better practices. Some solutions are in the hands of policymakers. Working together, we can foster a system of meat production, distribution and consumption that lowers beef’s foodprint. Change is on the horizon, and we all have a role to play in getting us there.

Hide References

- Mahanta, Siddhartha. “Big Beef.” Washington Monthly, January/February 2014. Retrieved July 10, 2019, from https://washingtonmonthly.com/magazine/janfeb-2014/big-beef/

- Ibid.

- Food and Water Watch. “Horizontal Consolidation and Buyer Power in the Beef Industry.” FWW, July 2010. Retrieved July 10, 2019, from https://www.foodandwaterwatch.org/sites/default/files/beefconcentration.pdf

- Rack, Andrea. “How Safe Is Your Ground Beef?” Consumer Reports, December 21, 2015. Retrieved July 10, 2019, from https://www.consumerreports.org/cro/food/how-safe-is-your-ground-beef

- Atkinson, Sophie. “Farm Animal Transport, Welfare and Meat Quality.” Swedish University of Agricultural Sciences, 2000. Retrieved July 10, 2019, from https://pub.epsilon.slu.se/11026/1/Atkinson_S_140221.pdf

- Smith, T. “Feedlot animal welfare. 2010 International symposium on beef cattle welfare.” Retrieved from https://www.api-virtu-allibrary.com/isbcw-2010/isbcw_temple-grandin-feedlot-welfare.htm#.VWInAeuH0S1

- Code of Federal Regulations. “Title 9. Part 313. 9 CFR 313 – HUMANE SLAUGHTER OF LIVESTOCK.” Cornell Law School Legal Information Institute, (n.d.). Retrieved July 10, 2019, from https://www.law.cornell.edu/cfr/text/9/part-313

- Mader, TL. “Environmental stress in confined beef cattle.” Journal of Animal Science, 81(14): 110-119 (February 2003). Retrieved July 10, 2019, from https://academic.oup.com/jas/article-abstract/81/14_suppl_2/E110/4789865

- Food and Agriculture Organization. “Guidelines for slaughtering, meat cutting and further processing.” FAO, 1991. Retrieved July 10, 2019, from https://www.fao.org/docrep/004/T0279E/T0279E00.htm#TOC

- Code of Federal Regulations. “Title 21. Part 573. 21 CFR – FOOD ADDITIVES PERMITTED IN FEED AND DRINKING WATER OF ANIMALS.” Cornell Law Legal Information Institute, (n.d.). Retrieved July 10, 2019, from https://www.law.cornell.edu/cfr/text/21/part-573

- Owens, Fred N. “Acidosis in Cattle: A Review.” Journal of Animal Science, 76: 275-286 (1998). Retrieved July 10, 2019, from https://www.researchgate.net/profile/Fred_Owens/publication/13765782_Acidosis_in_Cattle_A_Review/links/54ec9a2b0cf2465f532fbb6c.pdf

- Callaway, Todd R. “Diet, Escherichia coli O157:H7, and Cattle: A Review After 10 Years.” Current Issues in Molecular Biology, 11: 67-80 (2009). Retrieved July 10, 2019, from https://www.horizonpress.com/cimb/abstracts/v11/67.html

- Global Development and Environment Institute and Tufts University. “Feeding the Factory Farm.” GDAE, (n.d.). Retrieved July 10, 2019, from https://www.ase.tufts.edu/gdae/policy_research/BroilerGains.htm

- Ibid.

- Daley, Cynthia A et al. “A review of fatty acid profiles and antioxidant content in grass-fed and grain-fed beef.” Nutrition Journal, 9:10 (2010). Retrieved July 10, 2019, from https://www.nutritionj.com/content/9/1/10

- Animal Welfare Approved. “Beef Cattle and Calves Standards.” A Greener World, 2018. Retrieved July 10, 2019, from https://agreenerworld.org/certifications/animal-welfare-approved/standards/beef-cattle-and-calves-standards/

- US Government Accountability Office. “Concentrated Animal Feeding Operations: EPA Needs More Information and a Clearly Defined Strategy to Protect Air and Water Quality from Pollutants of Concern.” GAO, September 2008. Retrieved July 10, 2019, from https://www.gao.gov/assets/290/280229.pdf

- Pew Commission on Industrial Farm Animal Production. “Putting Meat on the Table: Industrial Farm Animal Production in America.” The Pew Charitable Trusts and Johns Hopkins Bloomberg School of Public Health, 2008. Retrieved July 10, 2019, from https://www.jhsph.edu/research/centers-and-institutes/johns-hopkins-center-for-a-livable-future/_pdf/news_events/PCIFAPSmry.pdf

- North Dakota State University. “Water Quality of Runoff From Beef Cattle Feedlots (WQ1667).” NDSU, 2013. Retrieved July 10, 2019, from https://www.ag.ndsu.edu/publications/environment-natural-resources/water-quality-of-runoff-from-beef-cattle-feedlots

- Fry et al. “Environmental health impacts of feeding crops to farmed fish.” Environmental International, 91: 201-214 (May 2016). Retrieved July 10, 2019, from www.sciencedirect.com/science/article/pii/S0160412016300587

- Mekonnen, MM and Hoekstra, AY. “The Green, Blue and Grey Water Footprint of Farm Animals and Animal Products. Volume 1: Main Report.” UNESCO-IHE, December 2010. Retrieved July 10, 2019, from https://waterfootprint.org/media/downloads/Report-48-WaterFootprint-AnimalProducts-Vol1_1.pdf

- Water Footprint Calculator. “The Water Footprint of Beef: Industrial vs. Pasture-Raised.” GRACE Communications Foundation, (n.d.). Retrieved July 10, 2019, from https://www.watercalculator.org/water-use/water-in-your-food/water-footprint-beef-industrial-pasture/?bid=4712/the-water-footprint-of-beef-industrial-vs-pasture-raised

- Hribar, Carrie. “Understanding Concentrated Animal Feeding Operations and Their Impact on Communities.” CDC, (2010). Retrieved July 10, 2019, from https://www.cdc.gov/nceh/ehs/docs/understanding_cafos_nalboh.pdf

- US Environmental Protection Agency. “Overview of Greenhouse Gases: Methane Emissions.” EPA, April 11, 2019. Retrieved July 10, 2019, from https://www.epa.gov/ghgemissions/overview-greenhouse-gases#methane

- Rodale Institute. “Regenerative Organic Agriculture and Climate Change: A Down-to-Earth Solution to Global Warming.” Rodale Institute, 2013. Retrieved July 10, 2019, from https://rodaleinstitute.org/wp-content/uploads/rodale-white-paper.pdf

- Schnepf, Randy. “CRS Report for Congress. Energy Use in Agriculture: Background and Issues. Order Code RL32677.” Congressional Research Service, November 19, 2004. Retrieved July 10, 2019, from https://rodaleinstitute.org/wp-content/uploads/rodale-white-paper.pdf

- Rodale Institute. “Regenerative Organic Agriculture and Climate Change: A Down-to-Earth Solution to Global Warming.” Rodale Institute, 2013. Retrieved July 10, 2019, from https://rodaleinstitute.org/wp-content/uploads/rodale-white-paper.pdf

- Ibid.

- Bureau of Labor Statistics. “NEWS RELEASE: Workplace Injuries and Illnesses – 2011.” US Department of Labor, October 25, 2012. Retrieved July 10, 2019, from https://www.bls.gov/news.release/archives/osh_10252012.pdf

- Davis, Meghan F. et al. “Occurrence of Staphylococcus aureus in swine and swine workplace environments on industrial and antibiotic-free hog operations in North Carolina, USA: A One Health pilot study.” Environmental Research, 163: 88-96 (May 2018). Retrieved July 10, 2019, from https://www.sciencedirect.com/science/article/pii/S0013935117317383

- Mole, Beth. “MRSA: Farming up trouble.” Nature, July 24, 2013. Retrieved July 10, 2019, from https://www.sciencedirect.com/science/article/pii/S0013935117317383

- US Government Accountability Office. “WORKPLACE SAFETY AND HEALTH: Additional Data Needed to Address Continued Hazards in the Meat and Poultry Industry.” GAO, April 2016. Retrieved July 10, 2019, from https://www.gao.gov/assets/680/676796.pdf

- Memo of Supreme Court Decision. “Wage and Hour Advisory Memorandum No. 2006-2.” US Department of Labor, May 31, 2006. Retrieved July 10, 2019, from https://www.dol.gov/whd/FieldBulletins/AdvisoryMemo2006_2.htm

- Institute of Medicine, Food and Nutrition Board. Cattle Inspection: Committee on Evaluation of USDA Streamlined Inspection System for Cattle (SIC-C). Washington, DC: The National Academies Press. Retrieved July 10, 2019, from https://www.ncbi.nlm.nih.gov/books/NBK235649/

- Ibid.

- Centers for Disease Control and Prevention. “Estimates of Foodborne Illness in the United States.” US Department of Health & Human Services, (n.d.). Retrieved July 10, 2019, from https://www.cdc.gov/foodborneburden/index.html

- Centers for Disease Control. “Contribution of Different Food Commodities (Categories) to Estimated Domestically-Acquired Illnesses and Deaths, 1998-2008.” US Department of Health & Human Services, (n.d.). Retrieved July 10, 2019, from https://www.cdc.gov/foodborneburden/attribution-image.html#foodborne-illnesses

- Batz, Michael B. et al. “Ranking the Risks: The 10 Pathogen-Food Combinations with the Greatest Burden on Public Health.” University of Florida, Emerging Pathogens Institute, 2011. Retrieved July 10, 2019, from https://folio.iupui.edu/bitstream/handle/10244/1022/72267report.pdf

- Ferdman, Roberto A. “I tried to figure out how many cows are in a single hamburger. It was really hard.” The Washignton Post, August 5, 2015. Retrieved July 10, 2019, from Https://www.washingtonpost.com/news/wonk/wp/2015/08/05/there-are-a-lot-more-cows-in-a-single-hamburger-than-you-realize/?utm_term=.08ab99a4dbda

- Consumer Reports. “Beef Report.” Consumer Reports, August 2015. Retrieved July 10, 2019, from https://advocacy.consumerreports.org/research/consumer-reports-beef-report/

- Heiman, Katherine et al. “Escherichia coli 0157 Outbreaks in the United States, 2003-2012.” Emerging Infectious Diseases, 21(8): 1293-1301. Retrieved July 10, 2019, from https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4517704/

- Consumer Reports. “Beef Report.” Consumer Reports, August 2015. Retrieved July 10, 2019, from https://advocacy.consumerreports.org/research/consumer-reports-beef-report/

- USDA Food Safety and Inspection Service. “Pathogen Reduction – Salmonella and Campylobacter Performance Standards Verification Testing.” United States Department of Agriculture, February 25, 2019. Retrieved July 10, 2019, from https://www.fsis.usda.gov/wps/wcm/connect/b0790997-2e74-48bf-9799-85814bac9ceb/28_IM_PR_Sal_Campy.pdf?MOD=AJPERES

- Consumer Reports. “Beef Report.” Consumer Reports, August 2015. Retrieved July 10, 2019, from https://advocacy.consumerreports.org/research/consumer-reports-beef-report/

- Dibner, JJ and Richards, JD. “Antibiotic Growth Promoters in Agriculture: History and Mode of Action.” Poultry Science, 84: 634-643 (2005). Retrieved July 10, 2019, from https://www.ars.usda.gov/alternativestoantibiotics/PDF/publications/12JJDibner.pdf

- US Food and Drug Administration. “Guidance for Industry #213 New Animal Drugs and New Animal Drug Combination Products Administered in or on Medicated Feed or Drinking Water of Food-Producing Animals: Recommendations for Drug Sponsors or Voluntarily Aligning Product Use Conditions with GFI #209.” FDA, December 2013. Retrieved July 10, 2019, from https://www.fda.gov/downloads/AnimalVeterinary/GuidanceComplianceEnforcement/GuidanceforIndustry/UCM299624.pdf

- World Health Organization. “Antimicrobial resistance: Key facts.” WHO, February 15, 2018. Retrieved July 10, 2019, from https://www.who.int/mediacentre/factsheets/fs194/en/

- World Health Organization. “Antimicrobial resistance: global report on surveillance 2014.” WHO, April 2014. Retrieved July 10, 2019, from https://www.who.int/drugresistance/documents/surveillancereport/en/

- Centers for Disease Control and Prevention. “Antibiotic/Antimicrobial Resistance (AR/AMR): Biggest Threats and Data.” US Department of Health & Human Services, September 10, 2018. Retrieved July 10, 2019, from https://www.cdc.gov/drugresistance/biggest_threats.html?CDC_AA_refVal=https%3A%2F%2Fwww.cdc.gov%2Fdrugresistance%2Fthreat-report-2013%2Findex.html

- Food and Drug Administration. “2014 Summary Report on Antimicrobials Sold or Distributed for Use in Food-Producing Animals.” US Department of Health and Human Services, 2014. Retrieved July 10, 2019, from https://www.fda.gov/downloads/ForIndustry/UserFees/AnimalDrugUserFeeActADUFA/UCM476258.pdf

- Hribar, Carrie. “Understanding Concentrated Animal Feeding Operations and Their Impact on Communities.” CDC, (2010). Retrieved July 10, 2019, from https://www.cdc.gov/nceh/ehs/docs/understanding_cafos_nalboh.pdf

- McEachran, Andrew D. et al. “Antibiotics, Bacteria, and Antibiotic Resistance Genes: Aerial Transport from Cattle Feed Yards via Particulate Matter.” Environmental Health Perspectives, April 1, 2015. Retrieved July 10, 2019, from https://ehp.niehs.nih.gov/doi/10.1289/ehp.1408555

- Ahmad, Aqeel. “Insects in confined swine operations carry a large antibiotic resistant and potentially virulent enterococcal community.” BioMed Central Microbiology, 11:23 (January 26, 2011). Retrieved July 10, 2019, from https://bmcmicrobiol.biomedcentral.com/articles/10.1186/1471-2180-11-23

- Nadimpalli, Maya et al. “Persistence of livestock-associated antibiotic-resistant Staphylococcus aureus among industrial hog operation workers in North Carolina over 14 days.” Occupational & Environmental Medicine, 72(2). Retrieved July 10, 2019, from https://oem.bmj.com/content/72/2/90.full#ref-5

- Consumer Reports. “Beef Report.” Consumer Reports, August 2015. Retrieved July 10, 2019, from https://advocacy.consumerreports.org/research/consumer-reports-beef-report/

- Ibid.

- Association of American Feed Control Officials. “Welcome to AAFCO.” AAFCO, August 2015. Retrieved July 10, 2019, from https://www.aafco.org

- Jones, Adam. “Tyson Foods Commands 24% of the Beef Market.” Market Realist, December 11, 2019. Retrieved July 10, 2019, from https://marketrealist.com/2014/12/tyson-foods-commands-24-of-the-beef-market/

- Wiles, Tay. “The ‘chickenization’ of beef.” High Country News, December 26, 2016. Retrieved July 10, 2019, from https://www.hcn.org/issues/48.22/obama-failed-to-protect-small-scale-ranchers-competing-against-big-ag

- Stone Barns Center for Food & Agriculture. “Back to Grass: The Market Potential for US Grassfed Beef.” Stone Barns Center for Food & Agriculture, 2017. Retrieved July 10, 2019, from https://www.stonebarnscenter.org/wp-content/uploads/2017/10/Grassfed_Full_v2.pdf

- Mahanta, Siddhartha. “Big Beef.” Washington Monthly, January/February 2014. Retrieved July 10, 2019, from https://washingtonmonthly.com/magazine/janfeb-2014/big-beef/

- USDA Agricultural Marketing Service. “USDA Amends Country of Origin Labeling Requirements, Final Rule Repeals Beef and Pork Requirements.” United States Department of Agriculture, February 29, 2016. Retrieved July 10, 2019, from https://www.ams.usda.gov/press-release/usda-amends-country-origin-labeling-requirements-final-rule-repeals-beef-and-pork

- Code of Federal Regulations. “7 CFR Port 205 – NATIONAL ORGANIC PROGRAM.” Cornell Law School Legal Information Institute, December 21, 2000. Retrieved July 10, 2019, from https://www.law.cornell.edu/cfr/text/7/part-205

- Rodale Institute. “Regenerative Organic Certified.” Rodale Institute, 2017. Retrieved July 10, 2019, from https://rodaleinstitute.org/regenerativeorganic/

- Franzlueberrs, Alan. “Cattle Pastures May Improve Soil Quality.” USDA AgResearch Magazine. March 2011. Retrieved July 10, 2019, from https://agresearchmag.ars.usda.gov/2011/mar/soil/

- Silveira, Maria et al. “Carbon Sequestration in Grazing Land Ecosystems.” University of Florida IFAS Extension, (n.d.). Retrieved July 10, 2019, from https://edis.ifas.ufl.edu/ss574

- Rack, Andrea. “How Safe IS Your Ground Beef?” Consumer Reports, December 21, 2015. Retrieved July 10, 2019, from https://www.consumerreports.org/cro/food/how-safe-is-your-ground-beef